This chapter goes through credit card validation and verification, such as is vital during the checkout procedure of an online shopping application. The chapter as a whole covers all aspects of the checkout procedure in detail.

This chapter goes through credit card validation and verification, such as is vital during the checkout procedure of an online shopping application. The chapter as a whole covers all aspects of the checkout procedure in detail.

This sample is taken from Chapter 7: "Credit Card Validation and Verification" of the Glasshaus title "Usable Shopping Carts"

In order to process credit-card transaction online, you need two things: a

merchant account with a bank or other financial institution that acts as a clearinghouse,

and the ability to provide a secure connection for the transmission of credit

card data. We'll talk about the former here, and defer discussion of the latter

to Chapter 8 (Security).

Different banks have different rules about who can have a merchant account,

but once you've got one the process is pretty much the same for all of them.

To obtain a merchant account you usually must have a registered business name

or license, a tax or business registration number and often several years

worth of accounts. If yours is a new business, a well-written business plan

may also be helpful. Some banks won't permit mail or phone or internet orders

on a new merchant account, and insist on a six-to-twelve-month assessment

period before they will let you process mail/phone orders. Different financial

institutions have differing policies; check these over carefully before signing

on the dotted line. Banks tend to be especially rigorous (and sometimes even

downright paranoid) with regard to Internet transactions. One beneficial side

effect of this, however, is they often have a preferred solution provider,

which can save you the trouble of setting up your own secure server (or of

processing all your transactions manually). On the other hand, this may include

a policy to the effect that if you use anything else, your transactions may

be refused, or the bank may insist on going over your arrangements with a

fine-tooth comb.

The following items apply mostly to manual transactions, which you'll need

to do in order to handle telephone, fax and mail-in orders:

1. Once

you've obtained a merchant account, you'll receive an imprinter or electronic

terminal (the former is much cheaper, the latter is easier), a merchant card

(sole use of this is to imprint merchant account details on credit card slips),

some phone numbers and instruction manuals, and the stationery required for

your imprinter so that you can do deposits, credits, and so forth. If you

anticipate a large volume of these transactions, you can usually obtain telephone

order pads rather than the single-transaction slips usually seen � these will

help streamline the process because much of the information you need to include

or imprint on single-transaction slips is pre-printed on these.

2. You'll

be given a "floor limit" (the maximum amount you can process without

authorisation, although you can get authorisation for every transaction if

it makes you feel better). You'll probably be charged a percentage of each

sale which can range anywhere from around 2.5% up to 4.9%; the high end of

this range tends to be the rule with new accounts. Some processors will charge

you a per-transaction flat fee � depending on your business model and average

prices of your products, this might be a better or worse deal for you than

a percentage of your sales. You should definitely shop around and see what's

available before making a commitment in this regard, whether you're looking

for your own merchant account or a one-stop-shop service provider (some of

whom will still require that you have your own merchant account in any case).

3. You'll

also receive a monthly list of invalid card numbers of all types which will

not be processed due to their being expired, stolen, lost, closed, and so

forth. You'll be expected to check all transactions to ensure the card isn't

listed. If you process a listed card without getting authorisation, it won't

be honoured, and you'll have to cover out of your own pocket.

4. If

the amount of a sale is over your floor limit, phone the merchant authority

number and request an authorisation. If you don't get this, don't make the

sale. Try again the next day or contact the customer; sometimes it's just

a glitch in banking system, but again, it may not be. Don't try to second-guess

the bank � the bank holds the purse strings. Follow their instructions and

policies to the letter.

If your business or that of your employer or client is relatively small,

we recommend that for "live" Internet credit card transactions you

use whatever system your bank provides or that you enter into an agreement

with a third-party processor. In this way you minimise your overhead. You'll

also help protect yourself from being liable in the event of major fraud or

a breach of security.

We'll meet up with some of these issues again in Chapter 8, when we discuss

security issues.

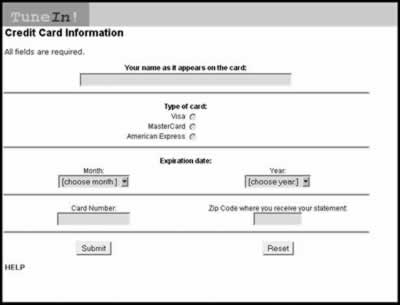

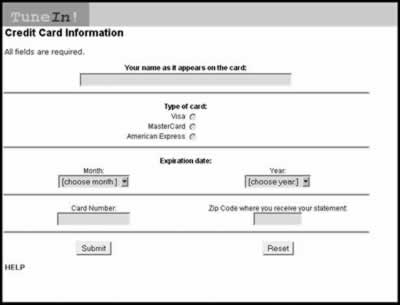

Credit Card Form Display

Different financial institutions have different policies regarding the information

they require about a credit card and cardholder before they'll authorize an

online sale. At a minimum they'll require the cardholder's name as it appears

on the card, the account number, and the expiration date. Some issuers are

beginning to include an extra numeric or alphanumeric code on the back of

the card but this practice is not (yet) universal. Some require complete address

verification, although an increasingly common practice is just to check the

cardholder's ZIP code or postcode against what's in the account's billing

records.

it's often the case that a customer wishes

to have items shipped to a different address than his actual billing address,

we'll obtain the complete billing address. If you use a third-party provider

such as PayPal or iBill, this form will reside upon the provider's server

but should look something like what we show here.

This chapter goes through credit card validation and verification, such as is vital during the checkout procedure of an online shopping application. The chapter as a whole covers all aspects of the checkout procedure in detail.

This chapter goes through credit card validation and verification, such as is vital during the checkout procedure of an online shopping application. The chapter as a whole covers all aspects of the checkout procedure in detail.

George Petrov is a renowned software writer and developer whose extensive skills brought numerous extensions, articles and knowledge to the DMXzone- the online community for professional Adobe Dreamweaver users. The most popular for its over high-quality Dreamweaver extensions and templates.

George Petrov is a renowned software writer and developer whose extensive skills brought numerous extensions, articles and knowledge to the DMXzone- the online community for professional Adobe Dreamweaver users. The most popular for its over high-quality Dreamweaver extensions and templates.

Comments

Be the first to write a comment

You must me logged in to write a comment.